This resident-written blog summarizes a speaking engagement from Brad Breeding at Otterbein Granville about the factors to consider when choosing a senior living community.

By Otterbein Granville resident Reed B.

Brad Breeding provides advice on senior living with the authority of an informed and objective observer. He is both the co-founder of myLifeSite.net, a website and online directory designed to assist people exploring senior living options; and the author of What’s the Deal With Retirement Communities?, an examination of the various choices available to readers thinking about life after retirement.

Brad has spoken at Otterbein Granville in the past, and one of his main points is this: Planning is essential! After all, as he said with a smile, quoting Yogi Berra, “If you don’t know where you’re going, you’ll wind up someplace else.”

What now follows is my effort to encapsulate his argument. Like Brad Breeding, I realize the stages of decision-making identified below are too logically ordered to reflect the sloppy way we human beings actually tend to think. But they do provide a guide for arriving at a well-considered final decision.

What is the Current Context for Senior Living?

The context for any thoughtful planning about retirement living must be the realization that the senior living environment in America is rapidly changing. Consider these three demographic points:

- Not only is the number of retirees growing each year, so too is the proportion of the national population that is 65 and older. In fact, at some point — and within the lifetime of some people retiring today — the number of Americans 65 and older will begin to exceed the number of Americans 21 and younger.

- These retirees are living longer than their parents, and during much of that longer life, they will expect, with the help of modern medicine, to be enjoying pretty good health.

- As a consequence, there will be ever-increasing pressure upon the country’s already-stressed health care system.

And while speaking of context, there’s something else to keep in mind. The members of what has been called the “gray tsunami” are moving into post-65 life with expectations different from their parents. They will not accept housing that seems like the “nursing homes” that their parents’ friends often wound up in. Instead, they want:

- A wide array of service options, dining choices, and cultural opportunities

- Open-concept floor plans

- Pocket neighborhoods

They want, in short, residential arrangements that encourage an active life and invite the shaping of authentic communities.

The First Big Decision: Where Will I Live?

Broadly speaking, the first decision that you as a retiree will make regards your residence — “Where will I live?” Once upon a time, older people often lived with their adult children and the families of those children. Today, although this step remains an option, moving in with one’s children is rarely the preferred one. Instead, the basic choice involves deciding whether to stay in one’s home or to move to a community that caters to seniors. Each choice has its advantages and disadvantages.

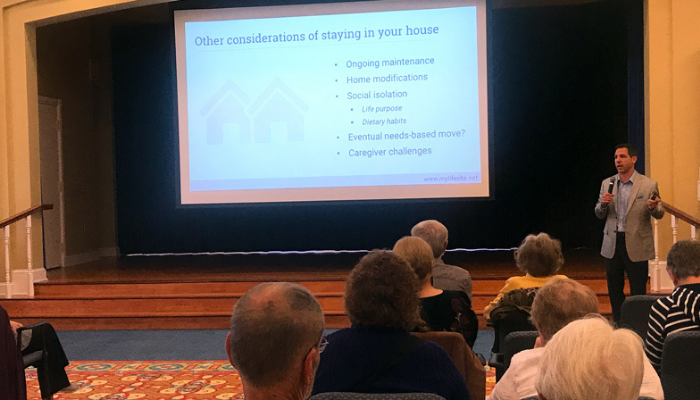

Brad Breeding’s point is that staying at home is not a deferring of a decision; it is itself a decision. And it may be the right one. After all, a simple financial calculation will often suggest that staying in one’s home is the less costly choice. His key point, however, is that you should think your options through — should plan — rather than fall back into some unconsidered default position. Why? Because a simple financial calculation may miss some important counter-considerations, such as:

- What is the full cost of ongoing maintenance of the home?

- Are you including the cost of home modifications?

- Does staying at home increase the likelihood of social isolation and loneliness, which in turn are major sources of poor health in seniors?

- What will happen if a sudden health crisis leads to a prompt needs-based move?

- Have you considered the costs and challenges posed by requiring the services of a caregiver?

Being fully aware of the genuine attractiveness of staying put, Brad Breeding is not so much trying to encourage people to move to a senior living community right away as trying to make sure that, in making their decision, they have thoroughly thought through what each option might entail.

The Second Big Decision: How Should I Pay for Future Care?

If you decide that you want to move to a senior community — that your prospects for leading a fulfilling life are likelier to be realized in an environment that exists to deal with the hopes, plans, and needs of seniors — then you face another big decision:

- Choose a community that structures its fee schedule in such a way as to promise you an unchanging level of regular payments even as your health needs come to require more attention

- Choose a community whose fee schedule involves charging additional fees for each step at which you need more services

The former option, with its level fee schedule across a continuum of services, is defined by what is called a life care contract; the latter, with what might be called an à la carte menu, is defined by a fee-for-service contract. Each has its advantages and disadvantages, and you are encouraged to compare and think them through.

The Third Big Decision: Do I Understand My Contract?

If you decide that you’d be best served by moving to a retirement community that will serve you for the rest of your life, with level fees, whatever your health needs — and this kind of senior living community is called both a Continuing Care Retirement Community (CCRC) and a Life Plan Community — then you need to understand the nature of the life care contract you will sign.

Not surprisingly, this step is centrally important: The life care contract defines the continuum of services your new residential community commits itself to provide, even as it fulfills its promise not to increase the cost of providing them across the continuum (beyond inflation, etc.).

The fullness of the array of possible contracts defies any effort at simple description, but there are important points to keep in mind as you think about them.

Entrance Fee

Most life plan communities require an entrance fee, which you are likely to deem substantial. It is important to understand that the amount of this fee is not arbitrary. It is derived from actuarial calculations that allow the community to be assured that it can care for you not only when you live independently, but also when you need assisted living help or nursing care facilities.

It is the community's desire to be confident in its actuarial assumptions that oblige management to request two kinds of information from applicants: evidence of the status of their health and the adequacy of their financial resources.

Refund Options

Some life plan communities offer declining refunds on the entrance fee, available when certain prescribed circumstances arise that terminate your residence there. Since the existence of possible refunds impacts the actuarial foundations of the contract, the entrance fee for contracts with refund options will be higher than the entrance fee for contracts without them.

Most life care contracts provide that, despite all precautions, if your funds run out, the community itself will provide financial support. Which is to say, once your entrance fee is accepted, you will not be required to leave the community due to an inability to pay.

Finally, current tax law permits residents with life care contracts to deduct a portion of that payment from their tax obligations. Obviously, since tax laws can be changed, this advantage cannot be contractually guaranteed to you. But its existence has proved a pleasant surprise to many who choose a life care contract.

The Last Big Decision: Which Community Will I Choose?

All that is left at this point is to choose the precise community you want to move to. Clearly, the choice of the geographical area you move to — whether close to the old home or far away — is based upon all sorts of personal considerations and preferences. But assuming the area you choose offers several different life care communities, you will probably want to ask about the following:

- What will your residential unit offer you (layout, space, amenities)?

- What contract options are available (see above)?

- What can you find out about the quality of the care that is offered?

- What can you find out about the quality of management and operations? How open is it? Does it have a track record of honoring responsibility? Who serves on the board?

- Is it a good financial fit for you?

- Does it offer the lifestyle hopes and wellness aspirations you are looking for?

Of these six considerations, Brad Breeding urges you not to disregard numbers 4 and 6. Management practices and assumptions can vary widely in the senior housing industry, and you want to make sure you will be happy with the practices of the community you are choosing.

As for wellness, though it is a catchy term in the life care business, it can mean many things. You should look for a community that has a comprehensive definition of wellness, embracing intellectual, social, vocational, spiritual, and emotional wellness in addition to simple and straightforward physical health.

Closing Considerations

If you want to have a good chance of enjoying a truly rich life in retirement, you need to imbue that life with a sense of purpose. That purpose can arise from doing something specific, like serving on the board of the community, but also from more general goals and roles, such as having opportunities to improve community life, to support one another, and to be a helpful person. And so, you should be seeking out communities that provide and nourish such opportunities.

In turn, this reminds us all that we don’t move to “places,” we move to “communities.” And by communities, we mean “support networks” — networks of shared aspirations and intentions — networks of caring — networks even (this is me speaking, though I would not be surprised if Brad Breeding agreed) of affection.

And so comes Brad Breeding’s final piece of advice. As you plan for your future in retirement, close your eyes and ask yourself, “What does peace of mind look like for me?” Then, let your planning be guided by your answer.

Explore Otterbein Granville